Generic Copays vs Brand Copays: Average 2024 Costs Explained

Dec, 15 2025

Choosing between a generic and brand-name drug isn’t just about the label on the bottle-it’s about what you pay at the pharmacy counter. In 2024, the difference in out-of-pocket costs between these two types of medications can be dramatic, and understanding how copays work can save you hundreds-or even thousands-of dollars a year.

How Copay Tiers Work in 2024

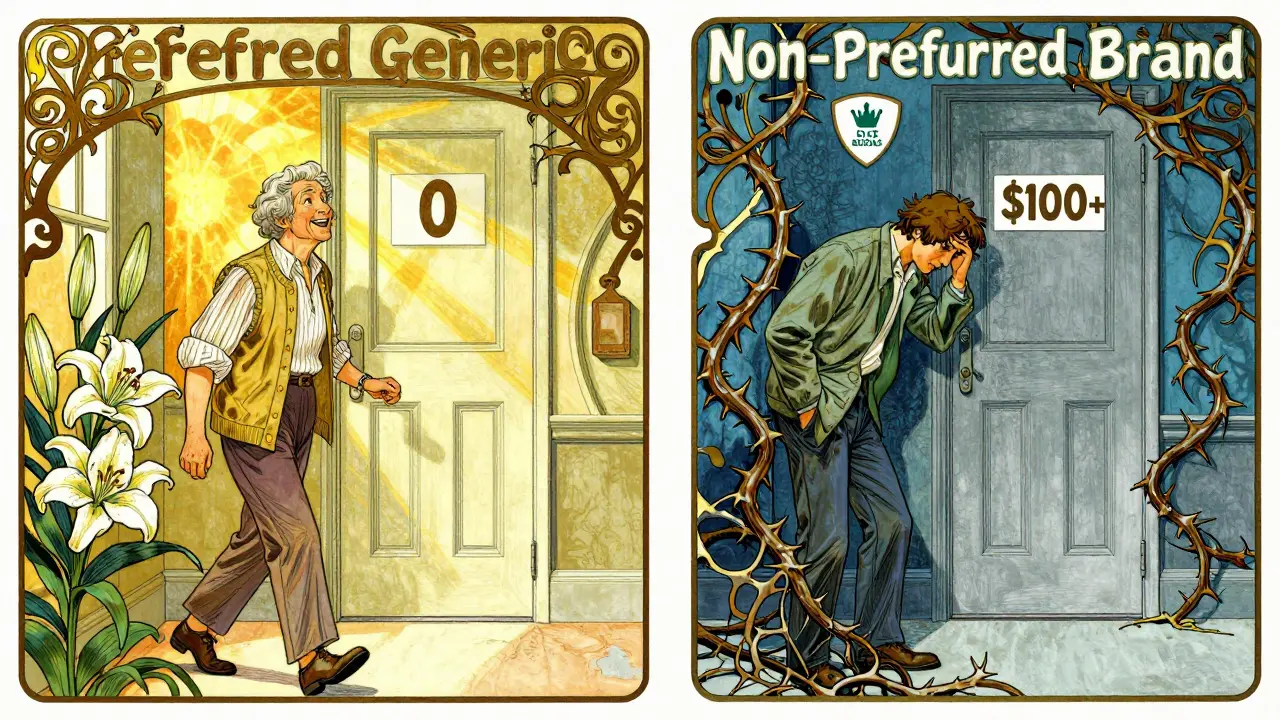

Most prescription drug plans in the U.S., including Medicare Part D and private insurance, use a tiered system to control costs. This system puts drugs into different levels, each with its own price tag. The most common structure has four tiers, sometimes five if specialty drugs are included.- Tier 1: Preferred Generic - These are the cheapest. Most plans charge $0 to $10 for a 30-day supply.

- Tier 2: Non-Preferred Generic - Slightly more expensive, often $7 to $15.

- Tier 3: Preferred Brand - Brand-name drugs your plan encourages. Copays range from $40 to $60.

- Tier 4: Non-Preferred Brand - Brand drugs your plan doesn’t favor. These can cost $100 or more per prescription.

- Tier 5: Specialty - High-cost drugs for complex conditions. These often involve coinsurance (a percentage of the total price), not a flat copay.

This structure isn’t random. It’s designed to nudge you toward cheaper, equally effective options. Generics make up 93% of all prescriptions but only 17% of total drug spending, according to IQVIA. That’s because they cost far less to produce and aren’t protected by patents.

Average 2024 Copay Numbers

For Medicare Part D enrollees in 2024, here’s what you could expect to pay:- Preferred generic: $4.50 average (some plans $0)

- Non-preferred generic: $7 average

- Preferred brand: $47 median

- Non-preferred brand: $100 median

These numbers come from KFF’s October 2024 analysis of Medicare Advantage Prescription Drug (MA-PD) plans. Standalone Prescription Drug Plans (PDPs) often use coinsurance instead of fixed copays. That means you pay a percentage of the drug’s total cost-sometimes 22% for preferred brands and up to 47% for non-preferred ones. Coinsurance can be unpredictable. If your brand-name drug costs $500, a 47% coinsurance adds up to $235 out of pocket.

Commercial insurance plans vary even more. Some use coinsurance too, while others have a “Member Pay the Difference” rule. That means if you choose a brand-name drug when a generic is available, you pay your regular copay plus the full price difference between the two. For example: if your generic costs $10 and the brand is $120, you pay $10 (your copay) + $110 (the difference) = $120 total. That’s not a copay-it’s a penalty.

Why the Big Price Gap?

You might wonder: if generics have the same active ingredients, why are they so much cheaper?It’s not about quality. The FDA requires generics to meet the same safety and effectiveness standards as brand-name drugs. The difference is in the cost of development. Brand-name companies spend millions on research, clinical trials, and marketing. Once the patent expires, other companies can copy the drug without those upfront costs. They sell it for a fraction of the price.

But here’s the catch: even though generics are cheaper to make, their prices in Medicare Part D aren’t always low. A 2024 report from the Medicare Payment Advisory Commission (MedPAC) found that some generic drug prices are higher than what you’d pay out of pocket without insurance. Why? Because of shady practices by wholesalers and pharmacies that tie generic pricing to brand-name drug deals. Independent pharmacists have reported being forced to accept inflated generic prices just to keep access to profitable brand drugs.

Medicare Advantage vs. Standalone Drug Plans

If you’re on Medicare, your plan type matters a lot.Medicare Advantage Prescription Drug (MA-PD) plans almost always use fixed copays. That means you know exactly what you’ll pay each time. In 2024, 97% of MA-PD enrollees paid a set copay for preferred brand drugs-median $47.

Standalone PDPs, on the other hand, are more likely to use coinsurance. That’s a percentage of the drug’s total cost. For non-preferred brand drugs, 78% of PDP enrollees pay 47% coinsurance. That’s risky. If your drug costs $300, you pay $141. If it costs $500, you pay $235. No cap. No predictability.

For people taking a lot of brand-name drugs, MA-PD plans often offer more stable costs. But if you mostly take generics, the difference between the two plan types shrinks.

What About the $35 Insulin Cap?

The Inflation Reduction Act of 2022 capped insulin costs at $35 per month for Medicare beneficiaries. That cap applies to both generic and brand insulin. So if you’re on insulin, you’re protected-no matter which version you use. But that’s one drug. For everything else, the tiered system still rules.By 2025, the out-of-pocket cap for all drugs will drop to $2,000 per year for Medicare Part D enrollees. That’s a big change. But until then, you’re still on the hook for high costs if you’re using non-preferred brand drugs.

Real People, Real Costs

People aren’t just numbers. Here’s what real users are saying:- “I paid $95 for a 90-day supply of a non-preferred brand drug. The generic would’ve been $15. My doctor won’t switch me because of side effects.” - RetireeInFlorida, MedicareInteractive.org

- “My plan charged me $42 extra just because I picked Lipitor instead of generic atorvastatin. My doctor said ‘dispense as written.’ Doesn’t matter.” - u/PharmaPatient, Reddit

A 2024 survey by the Medicare Rights Center found that 63% of people taking brand-name drugs struggled to afford them. Only 28% of people on generics had the same problem. And in the first quarter of 2024, complaints about unexpected brand drug costs made up 37% of all Medicare drug complaints-more than triple the number for generic-related issues.

How to Save Money in 2024

You don’t have to accept whatever your plan throws at you. Here’s how to take control:- Check your plan’s formulary. Every plan must publish its drug list by October 15 each year. Look up your exact medications-not just the names, but the dosage and strength.

- Compare plans using Medicare’s Plan Finder. It’s updated daily. Enter your drugs, zip code, and pharmacy. It shows you the real out-of-pocket cost for each plan.

- Ask your doctor about alternatives. 72% of Medicare plans have a preferred generic for at least 80% of common brand drugs. Maybe there’s a cheaper option that works for you.

- Use cash prices. Sometimes, paying cash at Walmart, Costco, or CVS is cheaper than using your insurance. Use GoodRx or SingleCare to compare.

- Don’t assume your copay is fixed. If you’re on a PDP, you might be paying coinsurance. Multiply the drug’s price by your percentage to see what you’ll really pay.

One Medicare counselor told Kaiser Health News: “A plan with a $5 generic copay and $100 brand copay might cost you $1,200 a year for a brand drug. Another plan with $0 generics and $40 brand copays might cost only $480.” That’s a $720 difference-just from picking the right plan.

What’s Coming in 2025

The big change is the $2,000 annual out-of-pocket cap for all drugs, starting in 2025. That means even if you’re on expensive brand-name drugs, you won’t pay more than $2,000 total for the year. After that, your plan covers everything.Also, 98% of 2025 Medicare Part D plans are expected to offer $0 copays for preferred generics. That’s up from 87% in 2024. But non-preferred brand copays are projected to rise to $105 median.

Bottom line: The system is getting better for people on generics. But if you need brand-name drugs, you’ll still need to shop carefully. The cap helps, but it doesn’t eliminate the gap.

Final Takeaway

Generic copays are low because they’re meant to be used. Brand copays are high because they’re meant to be avoided-unless absolutely necessary. The difference isn’t just about money. It’s about strategy. If you take multiple prescriptions, your plan’s formulary structure could cost you hundreds or thousands more than you realize.Don’t just pick a plan because it has the lowest monthly premium. Look at what you actually take. Run the numbers. Ask questions. And if your doctor says a brand drug is necessary, ask if there’s a generic alternative you can try first. Most of the time, there is.

Are generic drugs as effective as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as their brand-name counterparts. They must also meet the same quality and safety standards. The only differences are in inactive ingredients, packaging, and price. Most people experience no difference in effectiveness or side effects.

Why do some plans charge more for brand-name drugs even when a generic is available?

Plans use higher copays to encourage cost-saving choices. Generic drugs cost far less to produce and help lower overall drug spending for insurers. By making brand-name drugs more expensive, plans reduce their own costs-and often pass some of those savings to members through lower premiums. Some plans also have policies like “Member Pay the Difference,” where you pay the full price gap between the generic and brand version.

Can I switch from a brand-name drug to a generic without my doctor’s approval?

Your pharmacist can often substitute a generic for a brand-name drug unless your doctor specifically writes “dispense as written” or “no substitution.” Even then, you can still ask your doctor if a generic is safe and appropriate for you. Many doctors are open to switching if it reduces your out-of-pocket costs and there’s no medical reason to avoid it.

What if I can’t afford my brand-name drug even with insurance?

You have options. Ask your doctor about therapeutic alternatives on lower tiers. Check if the drug manufacturer offers a patient assistance program. Use discount apps like GoodRx or SingleCare to compare cash prices. For Medicare beneficiaries, Extra Help (a low-income subsidy) can reduce copays to $4.50 for generics and $11.20 for brand drugs. You can also appeal your plan’s coverage decision if you believe your drug should be covered at a lower tier.

Is it worth paying for a plan review service?

If you take multiple medications, especially expensive ones, yes. A professional review typically costs $75-$150 but can save you an average of $420 per year, according to the Medicare Rights Center. They look at your exact drugs, pharmacy choices, and plan tiers to find the lowest-cost option. For people with complex needs, that’s often a no-brainer.